Possibilities for Progressive Taxation of Salaries in Serbia – Who Would Benefit, What Would It Mean for the Employers, and How Much Would the State Budget Lose?

Monday, 11.12.2023.

Monday, 11.12.2023.

11:56

11:56

– With the introduction of progressive taxation of salaries, all workers who are paid salaries up to the net amount of around RSD 200,000 (according to the 2022 data), would have their salaries increased. Above the net amount of RSD 200,000, the tax would progressively grow, so the net amount of the highest salaries would lower proportionally. The total tax charges on gross salaries higher than RSD 520,000 would be 18.8% and up. In practice, that would mean that the employees with the highest salaries, who are a minority, would accept the principle of social solidarity and the redistributive role of the tax system for the benefit of the majority of the population – Tamindzija says.

She adds that today the things are the other way around, looking at the total salary charges at the expense of the employee and keeping in mind that the highest monthly principal amount for the payment of contributions for social insurance is defined by the law at five average gross salaries.

– So, for example, the employees who work for the minimum wage, set aside 20% of their gross salary for contributions, whereas somebody who earns a net salary of RSD 500,000 sets aside less than 15% of their total gross salary for contributions.

The payment of contributions for health insurance also has an upper limit.

– It is important to note that progressive salary taxation is in no way sufficient as a measure if our goal is to improve the overall low standard of the majority of the populace in Serbia and that we need a reform of the entire tax system and the system of social benefits. Serbia, for example, is one of the rare countries without tax exemptions for dependent members of a household. Also, it is possible to implement a progressive approach to the payment of contributions for health insurance and thereby additionally unburden the lowest salaries etc. – our interviewee points out.

Proposed models of progressive taxation of salaries

Tamindzija explains that, in defining the models of progressive taxation, they did calculations based on the available data of the Statistical Office of the Republic of Serbia about the distribution of salaries from 2022, and that, in determining the non-taxable, part, they used the Eurostat definition, according to which all salaries up to 67% of the average gross salary are considered low.

– In the first option, the non-taxable part is at a level of 50% of the gross salary, in the second, at 67%. After that amount, in both options, we have proposed four tax rates. The first is 10% for up to two average gross salaries. A tax rate of 16% is implemented for salaries between two average gross salaries and three average monthly gross salaries. Further, 32% on salaries between three and five average gross salaries and 42% tax is paid on an amount exceeding five average gross salaries – she says.

The difference between these two options is that the first one would be income-neutral, whereas the other option would lower the budget revenues by a certain percentage.

– However, by setting the non-taxable part at 67% of the average gross salary, we would get an increase in low and “medium” salaries and, if we had the power to truly propose law amendments, that is the option we would advocate – says the author of the research.

What would be the loss to the state budget?

If the non-taxable part of a salary were to be set at 67% of the average gross salary and if four tax rates were then implemented, the total budget revenues from the salary tax would be 16% lower on a monthly level, that is, by RSD 2.8 billion.

This reduction, as Tamindzija points out, is not insignificant, if we look at the budget revenues based on the salary tax. However, she adds, if we look at the total tax revenues, this becomes less significant, considering that it comprises around 1.28% of the total tax revenues on a monthly level.

– Our intention is not to make the public budget lose its revenues, but to demand a more selective spending of the public money. In order for the tax system to have a more pronounced redistributive character, it is necessary to compensate for a part of the tax revenues either through an increased taxation of the wealthy or through certain savings within the public budget. There are not many people who have pronouncedly high salaries in Serbia. On the other hand, salary increases gained through both proposed options, although very significant for the employees with low earnings, do not raise the low salaries up to a satisfactory level. That is why a further reform of the tax system is needed, so as to encompass the wealth which is located outside the salaries themselves, whereby the conditions would be created for the tax system and the system of social benefits on the whole to perform their regulatory and protective role – she points out.

The motive for preparing the propositions of the models for a progressive taxation of salaries, Bojana Tamindzija adds, comes precisely from the need to solve the problem of the poverty of workers in Serbia, as well as the need to intervene when it comes to the enormous and growing inequalities in our society.

– We see the cause of the overall poverty and the bad living standard in the fact that, with the restoration of capitalism and the loss of its own production base, Serbia has turned into an economically fully dependent state, which is structurally forced to compete in attracting foreign capital with other countries with cheap labor force, keeping the salaries at an extremely low level. However, it is also evident that the state is not using the existing maneuvering space within national boundaries through social and tax policies to improve the living standard of the widest layers of the populace. A more just redistribution of the wealth requires essential social and economic changes on a global level. Still, there are certain policies which, even with the limited reach, can improve the standard of the populace and mitigate the consequences of the structural pressure, which is a consequence of Serbia’s position in the global system – our interviewee explains the motives for the preparation of the models of progressive salary taxation.

What is it like in other countries?

The recent research published by the World Bank has shown that taxpayers are more prepared to pay taxes if their character is progressive, says the CPE research.

Progressive salary taxation is nothing new, and the manner of implementation varies from country to country.

In Austria, there are seven tax grades. The threshold of the non-taxable part is at EUR 11,000 on an annual level, and then the tax rates grow progressively. A rate of 20% applies to salaries from EUR 11,000 to 18,000, a rate of 32.5% applies to a part of a salary up to EUR 31,000, 42% on a part of a salary up to EUR 60,000, 48% on a part of a salary up to EUR 90,000, 50% on a part of a salary up to EUR 1 million and 55% to every euro above one million.

In France, the non-taxable part threshold is EUR 10,777 on an annual level, and then the tax rate grows progressively from 11% to 45% for all those who earn more than EUR 168,994 on an annual level.

In Slovenia, 44% of an average salary is not taxed, and then a 16% tax is paid for salaries up to EUR 8,755 a year. The tax rates further progressively grow from 26% to 45% for all those who earn more than EUR 74,160.

– This is not a complete overview, and the system of taxes and contributions is much more complex – often, your marital status, or whether you have dependent members of the household, is taken into account, or it is supplemented with a progressive rate of contributions for healthcare, as is the case in Slovakia – says the research of the Center for the Politics of Emancipation (CPE).

I. Zikic

Naš izbor

Most Important News

06.04.2024. | Agriculture

Preconditions for Placement of Fresh Blueberries and Dried Plums in Chinese Market Secured

16.04.2024. | News

Jovan Ciric, Leasing Director Retail MPC Properties – MPC Echo symbolizes our desire for good ideas and innovative endeavors to spread freely and bring about positive changes

16.04.2024. | News

10.04.2024. | Finance, IT, Telecommunications, Tourism, Sports, Culture

Creative Industry – What This Serbian Economy Sector Worth EUR 2 Billion Encompasses

10.04.2024. | Finance, IT, Telecommunications, Tourism, Sports, Culture

26.04.2024. | Industry, Construction

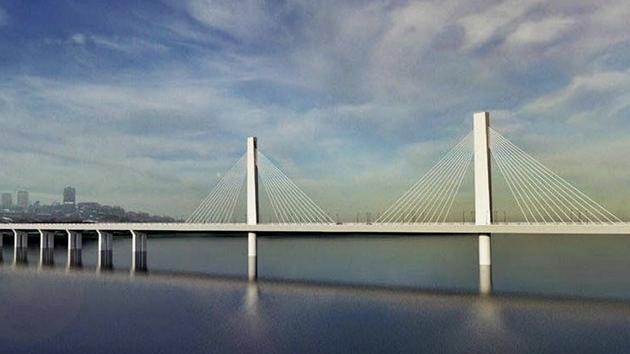

Plans for continuation of construction of Belgrade sewer system announced – Section beneath river Sava to be 414 meters long, reconstruction of Karaburma tunnel

26.04.2024. | Industry, Construction

16.04.2024. | News

Economy Fair in Mostar opens – 26 companies from Serbia exhibiting

16.04.2024. | News

26.04.2024. | Construction

CLS: Where is the Ada Huja bridge project?

26.04.2024. | Construction

Izdanje Srbija

Izdanje Srbija Serbische Ausgabe

Serbische Ausgabe Izdanje BiH

Izdanje BiH Izdanje Crna Gora

Izdanje Crna Gora

News

News