Turks become co-owners of Sarajevo Stock Exchange

Wednesday, 02.03.2011.

Wednesday, 02.03.2011.

14:55

14:55

Three Turkish finance institutions will enter the ownership structure of the Sarajevo Stock Exchange, that stock exchange announced.

The Istanbul Stock Exchange, Takasbank, which is the settlement agent for the Istanbul Stock Exchange, and the Central Registry of Turkey will acquire 5% of shares of the Sarajevo Stock Exchange each. These institutions sent the letter of intent last week, expressing an interest in the acquisition of shares of the stock exchange in Sarajevo. At a session on February 25, the Supervisory Board of the Sarajevo Stock Exchange backed the entrance of Turkish institutions to the ownership structure through issuance of new shares and ordered the Management to start the process of recapitalization.

Successful recapitalization would make it possible for the stock exchange to get additional capital for further development and it would also be able to count on other benefits in the form of a greater presence of foreign investors, transfer of knowledge, and a greater capacity of the stock exchange. According to unofficial information, Turkish investors will pay over KM 400,000 to enter the ownership structure, while shares will be sold at the market price instead of nominal one.

Current owners of the Sarajevo Stock Exchange are broker companies that have equal stakes of 5.3%, while 6% of shares are in the possession of the Sarajevo Stock Exchange, which will have to sell them by the force of law. Sarajevska berza-burza d.d. Sarajevo

Sarajevska berza-burza d.d. Sarajevo

Most Important News

06.04.2024. | Agriculture

Preconditions for Placement of Fresh Blueberries and Dried Plums in Chinese Market Secured

16.04.2024. | News

Jovan Ciric, Leasing Director Retail MPC Properties – MPC Echo symbolizes our desire for good ideas and innovative endeavors to spread freely and bring about positive changes

16.04.2024. | News

10.04.2024. | Finance, IT, Telecommunications, Tourism, Sports, Culture

Creative Industry – What This Serbian Economy Sector Worth EUR 2 Billion Encompasses

10.04.2024. | Finance, IT, Telecommunications, Tourism, Sports, Culture

29.04.2024. | Construction, Transport

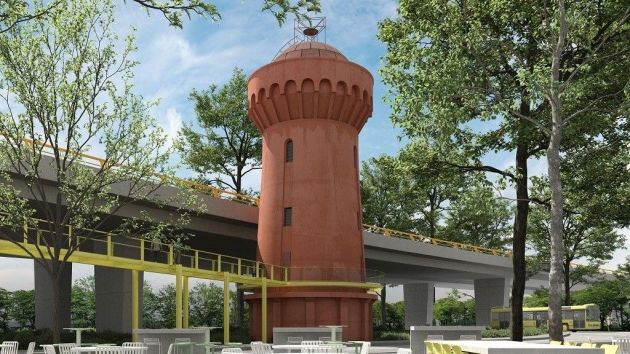

Tender for reconstruction of water tower and construction of footbridge within Lozionica worth EUR 12.6 million opened

29.04.2024. | Construction, Transport

16.04.2024. | News

Economy Fair in Mostar opens – 26 companies from Serbia exhibiting

16.04.2024. | News

28.04.2024. | Industry, Construction

Sombor sells 21 ha of land in Industrial Zone

28.04.2024. | Industry, Construction

Izdanje Srbija

Izdanje Srbija Serbische Ausgabe

Serbische Ausgabe Izdanje BiH

Izdanje BiH Izdanje Crna Gora

Izdanje Crna Gora

News

News