Djordje Ostojic, Financial Analyst ŌĆō Learn to Spend Less Than You Earn and Invest the Difference

Wednesday, 26.04.2023.

Wednesday, 26.04.2023.

15:51

15:51

During his studies, he perfected his knowledge in Germany, and immediately upon his return to Serbia, he gained employment as a financial analyst, and his main tasks are financial analysis and reporting.

After he got employed, he made the decision to apply all the knowledge he had to his own finances, which, as he says on his blog, has produced good results. He has described all the knowledge he has in a course and books, and all the described examples and example from real life and are applicable in Serbia and the Balkans.

For eKapija, he reveals some of the tricks for a better finance management, saving and investing.

eKapija: How would you define financial independence and what are its preconditions?

ŌĆō Financial independence can be considered the ŌĆ£Holy GrailŌĆØ of personal finance management, and the standard definition says that the concept of financial independence designates the condition in which we have enough savings and invested capital with which could cover our costs until the end of our lives without having to work. That sound quite utopian, but it is possible, as proven by good practical examples.

In order to calculate how much money we need for financial independence, we could use the data from the Trinity study, an analysis named after the institution where it was carried out. In this analysis, the authors found that withdrawing up to 4% of the invested funds on an annual level is enough for us never to run out of capital, that is, for the value of our portfolio not to go down to zero over a thirty-year period.

It follows from this that independence requires saved and invested funds in the amount of 25 times our annual costs. This would mean that, for a relatively modest budget of EUR 600 a month, assets of around EUR 180,000 are required, which is quite a challenge. The conclusion from this calculation is that we primarily need to invest in order to accelerate the tempo at which we accumulate property by making a profit, and second, to try to be more economical with our expenditures, because in that case, the value of the total sum of the capital we need is reduced.

In order to show that this endeavor is not impossible, we could take the example of a person who earns EUR 900 a month and spends said EUR 600 a month. With an investment yield of 5% on an annual level (which is fully realistic and feasible), this person would need around 26 years to reach financial independence. Of course, along the way, there will certainly be increases in both the costs and the earnings, so every once in a while, it is necessary to do the calculation again in order to see how much time weŌĆÖve got left until we reach our goal.

As for other preconditions, which are not related to the invested capital, there are very few of them, but they are demanding. The most basic thing is to define what our concrete plan is. I would start out with long-term goals (there can be one, but I wouldnŌĆÖt go with more than three goals), and they I would break them down into medium-term plans for a period of five next years, and then I would break down those medium-term goals into a range of one-year short-term goals.

This hierarchy of goals brings down those distant, seemingly unreachable goals to the level of short-term and (I hope), achievable goals, whereby we maintain our motivation to constantly work on meeting those goals. Of course, itŌĆÖs easier said than done and there will certainly be unexpected events in our lives, but itŌĆÖs important to have concrete goals and to know that fulfilling small goals step by step leads to fulfilling those big, long-term goals.

eKapija: You spent a certain time period developing your career in Germany. To what extent is finance management different in Germany compared to Serbia? Are there differences in priorities?

ŌĆō I have had the honor of getting to know the German finance culture over a longer time period and noticing some major differences in personal finance management. I would like to list some differences that were the most dramatic to me, but I have to say that my personal experience cannot guarantee that everybody will act that way.

The first big shock were the negotiations about the salary in job seeking, where the employers communicate the gross salary and it is up to each employee to calculate the net salary based on the individual situation. Although this phenomenon is conditioned on the specificities of the German tax system, I believe that itŌĆÖs a good thing for each employee to be aware of how much of their salary is set aside for taxes and contributions.

The second major special characteristic is certainly frugality, where, for example, it is entirely usual, when going to a restaurant, for everybody to pay their part of the bill. Also, although the living standard is perceptibly higher than ours, it is entirely normal for an average German to be not as well dressed as an average Serb. Of course, there are always exceptions, but it seemed to me that much less attention is paid to the image and status symbols. The use value and functionality were always above the appearance and the design.

Finally, I would like to highlight something that I found interesting that is very rare here in Serbia, primarily due to an undeveloped capital market. It was fascinating to me to hear that some colleagues in senior positions got an annual bonus, but not in monetary form, but in the form of company shares. A more experienced colleague, who had already gone through several serious companies, showed me his portfolio on that occasion, which predominantly featured shares of the companies in which he had worked, and which he had gotten through annual bonuses. On that occasion, he explained to me that he planned to ŌĆ£retireŌĆØ early with the help of the dividends he got from that, which had a decisive effect on me to start looking into this field.

eKapija: Are there any misconceptions that affect the decision to start saving and how can people be motivated to make that step?

ŌĆō Every person has a unique understanding of and experience with money, so it is very difficult to make some general conclusions such as would encompass all the most important things. Here, I will try to encompass some of the most frequent misconceptions that IŌĆÖve seen in my clients and people in my surroundings, but I have to note that there will probably be some things that have not ŌĆ£caught my eyeŌĆØ.

Considering that a large number of my clients is still relatively young (population under 30 and younger), a large number of them has the YOLO (you only live once) misconception. This sentence often incites careless spending, and even excessive borrowing, which leads to serious consequences in the long term. Although my position is that we should be somewhat more relaxed about money while weŌĆÖre young, we have to be aware that, as early as when weŌĆÖre 18, we can make some pretty bad financial moves. For that reason, I would advise to start setting aside 10-15% of the first salary for the savings, just to form the habit. And if you can do so, it would be even better to automate the savings.

Another great misconception usually arises in the period when we have already started working and earning, which is the ŌĆ£IŌĆÖll save at the end of the monthŌĆØ syndrome. This is present in those persons who are fully aware of the need for saving, but can never manage to organize themselves to realize that saving. If this is left for the end of the month, it usually happens that something comes up, or we give ourself the freedom to fail and make an impulse buy, which has as a consequence the fact that thereŌĆÖs nothing left on our accounts at the end of the month. I strongly recommend to set aside the money planned for saving immediately, on the day we get the salary, and to spend the rest of the money in line with our plans. This small change in the timing of the setting aside of the money for saving leads to dramatically better results in practice.

As the final big misconception, I can highlight the conviction that we save money if we buy at discounts. I would have to emphasize that it is possible to save if we buy at discounts, but only if the purchase was planned ahead and if we really need the item or the service we are purchasing. However, what happens in most cases is that the advertised discounts act as the trigger for an impulse purchase and that should absolutely be avoided. The solution to this problem is to plan our purchases, which gives us time to, above all, think about our needs, secure the money for the purchase, and then finally look into where we can find the best price for that product or service.

eKapija: You have linked savings with investments. In what way?

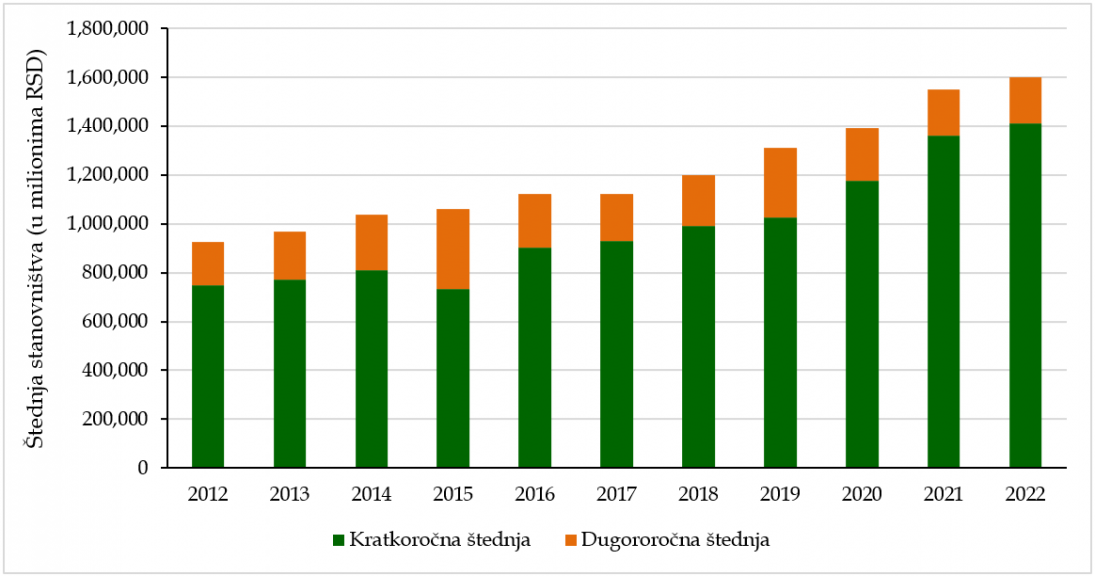

ŌĆō Primarily, in order to be able to invest, we need to have some savings that we will deploy through investing. According to the NBS data, the savings of the retail clients in the banks in the Republic of Serbia amount to around EUR 14 billion and it should also be emphasized that there is a tendency of growth. WhatŌĆÖs discouraging is that the majority of the populace sees savings in banks as the only way to increase their property.

This is deeply discouraging because of the fact that the interest rate on fixed-term savings never exceeds the inflation rate, which is why it may seem to us that we have more and more money on the account (we realize a yield in the nominal sense), but the cold fact is that we can actually buy fewer products and services with that money due to the inflation (we realize a loss in the real sense).

The only way to make progress in the real sense as well is to invest our hard saved money in more risky property (such as, for example: shares, ETFs, real estate, cryptocurrencies etc.). Real estate is traditionally the most popular investment in this area (because I personally donŌĆÖt consider fixed-term savings in a bank to be an investment), whereas the culture on investing in the stock exchange and in cryptocurrencies is still in development, but we can say that younger generations are much more active when it comes to that.

It should be pointed out that each investment involves a risk, but by setting our personal appetite against the risk, the investment period and through smart diversification, we can somewhat reduce the risks we are exposed to. Of course, thereŌĆÖs always the rule that you donŌĆÖt have to do anything if youŌĆÖre not comfortable with it, so it is advisable to seek advice if you donŌĆÖt fully understand an investment offer.

To conclude the answer to this question, I would like to emphasize that, from a financial aspect, it is recommendable to keep a certain amount on the bank account as a ŌĆ£rainy day fundŌĆØ, for urgent or unpredicted costs (or unpredicted situations such as the loss of a job), but that amount should not exceed our six-month costs.

eKapija: To those interested, you have also enabled a course about personal finances. Who should choose this course and is finance management a skill that needs to be constantly perfected?

ŌĆō When I started publishing content about personal finances, I have to admit that I had no intention of creating a course with that topic. However, the questions posed by the viewers and the followers made me realize that this was an extremely popular topic (primarily investments), so I decided to offer a course that would offer, in one place, everything essential for the organization of personal finances and the beginning of investments.

I have to emphasize that the information is, in a large number of cases, available online, and that it can all be found if we know what weŌĆÖre looking for. The problem, however, is that the information is scattered all over the internet, due to which the education is made much more difficult and time-consuming. My idea was to encompass the key things when it comes to personal finance management and to make some concrete tools and then to publish it all in one place.

What is personally a great satisfaction for me is that, in addition to giving me praise, the attendees of my course also ask me concrete questions, which shows to me that they have gone through all the materials very carefully and that they have started implementing the knowledge. At the end of the day, expert knowledge is worth nothing unless those who attend the course start actively applying it. I would also like to emphasize that, with their questions and uncertainties, the attendees affect the further development of the course, so another, upgraded version is already being prepared and should soon be available for purchase.

As for the second part of the question, finance management is essentially simple and unchangeable. Thousands of years of financial knowledge can be summed up in one sentence: ŌĆ£Spend less than you earn and invest the difference.ŌĆØ However, new forms of employment and online earning, online purchase, modern technologies and new forms of investing have led to the fact that managing each aspect of our finances is changing almost constantly. Due to this, it is important for us, as the protagonists of our financial stories, to constantly develop and follow what happens in our environments.

eKapija: Is there a motto you live by when it comes to finance?

ŌĆō When it comes to finance, there is a motto which has helped me dramatically, and it is a quote by Peter Drucker, who said on one occasion: ŌĆ£If you canŌĆÖt measure it, you canŌĆÖt manage it.ŌĆØ In the case of our finances, this would mean that, unless we write down our income and expenditures, we will never be able to move toward realizing our financial goals.

It perhaps sounds too simple, but monitoring our finances is the crucial first step which will get us moving. Talking to the purchasers of said course, I learned that it was shocking to them to learn how much they were spending on certain categories, without being aware of it. By the simple act of writing down our costs, we make it easier for ourselves to identify the critical parts of our home budget, after which it is easy to adjust our habits in order for our spending to get closer to the goals weŌĆÖve set.

Aleksandra Kekic

Na┼Ī izbor

Most Important News

11.03.2024. | Healthcare

Are Marketing Experts Reading Our Minds? ŌĆō eKapija Investigates: What Neuromarketing Is and How Much It Is Used in Serbia

11.03.2024. | Construction, Transport

Tender for Continuation of Construction of Patrijarha Pavla Blvd Stopped ŌĆō Contractors Demanding Price Higher Than Estimated

11.03.2024. | Construction, Transport

11.03.2024. | Construction, IT, Telecommunications

Auction for 5G Network by End-Year, Minister Announces

11.03.2024. | Construction, IT, Telecommunications

15.04.2024. | Energy, Industry

Vinca Solid Waste Management Center to start producing heating and electrical energy in the next month

15.04.2024. | Energy, Industry

17.01.2024. | Industry, Healthcare

Ceremony of Opening of Centers of Excellence in Kragujevac Planned for Spring ŌĆō Official Beginning of Operations in June

17.01.2024. | Industry, Healthcare

15.04.2024. | Construction, Transport, Finance

City approves signing of agreement with Ministry of Economy and BAS on continuation of financing of project of new bus station ŌĆō EUR 20 million over two years

15.04.2024. | Construction, Transport, Finance

Izdanje Srbija

Izdanje Srbija Serbische Ausgabe

Serbische Ausgabe Izdanje BiH

Izdanje BiH Izdanje Crna Gora

Izdanje Crna Gora

News

News